Who doesn't like the idea of earning money while they sleep? As interest rate hikes plateaued, the yield on 10-year U.S. Treasury bonds has dipped to around 4%. In 2024, interest rates are expected to trend downwards. Typically in such scenarios, dividend stocks will offer yields higher than bonds to offset the additional risk associated with stock investments.

Capital is likely to flow into high-dividend stocks, boosting their prices. Dennis Debusschere, president of 22V Research, forecasts: ' Expect [dividend growth stocks] to keep working as interest rates decline.*'

So, what's the best strategy for picking top-performing dividend stocks?

When picking dividend stocks, here's what you should keep an eye on:

Look for Long-Term Winners

You want companies that have been consistently doing well, not just those who had a good quarter or two. Aim for ones showing steady growth in their profits, somewhere between 5% and 15%. Super-high growth can be risky, sometimes those companies hit a rough patch and their stock prices take a hit.

Cash is King

Make sure the company has a good flow of cash. This is key for them to keep paying out dividends. A good sign is if they've been paying solid dividends for at least five years.

Watch Out for Debt

Stay away from companies buried in debt. They're likely to use their cash to pay off debts instead of paying you dividends. A quick tip: check their debt-to-capital ratio. If it's over 2.00, better to pass and find a better option.

Follow Market Trends

Don't just look at the company's numbers, think about where their industry is heading. Staying informed with current news is beneficial. For example, with the aging baby boomer population, healthcare services are likely to be in demand, making them a potentially good pick for dividend growth.

So, how to efficiently select high-yield stocks from a multitude of options?

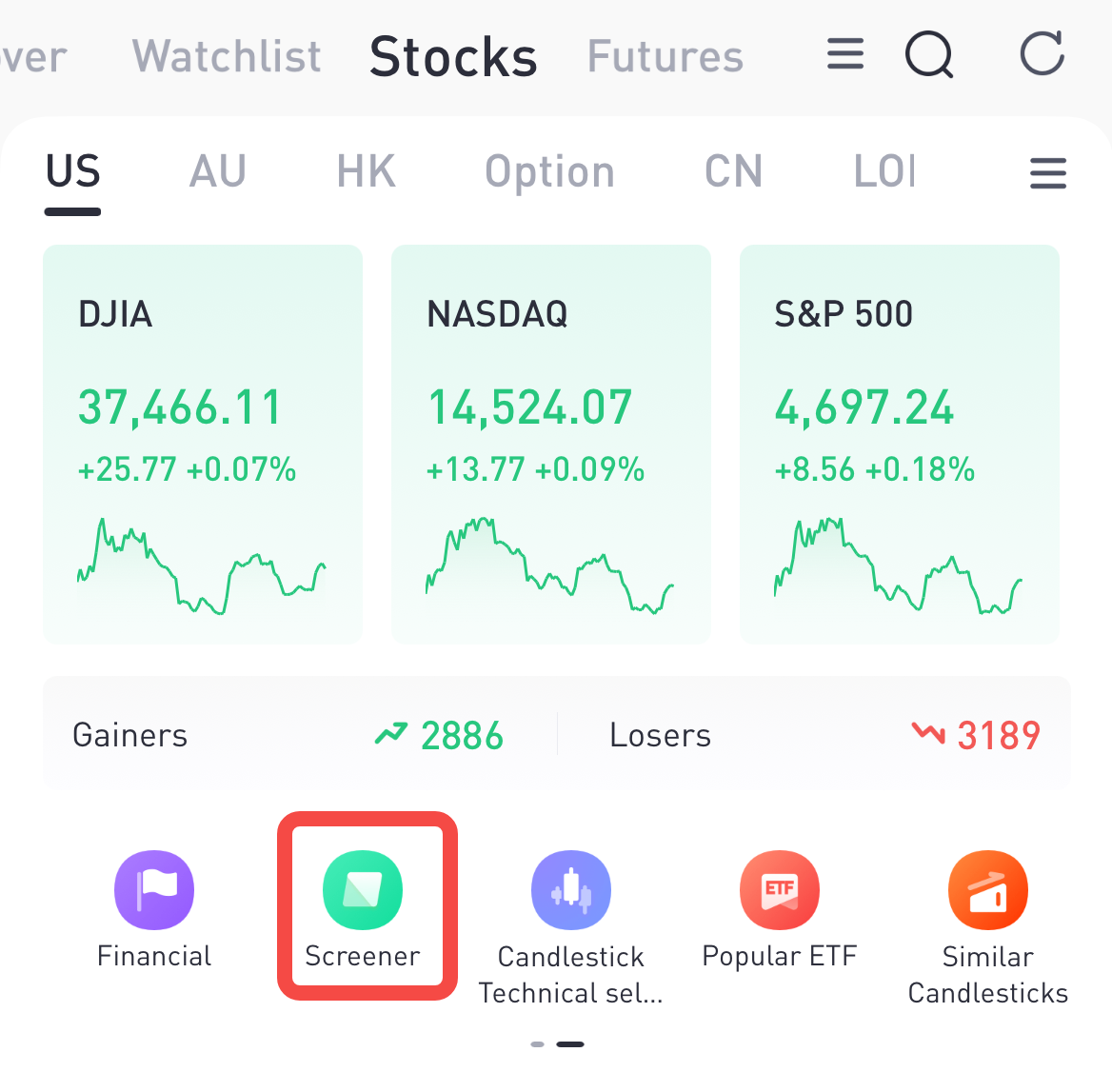

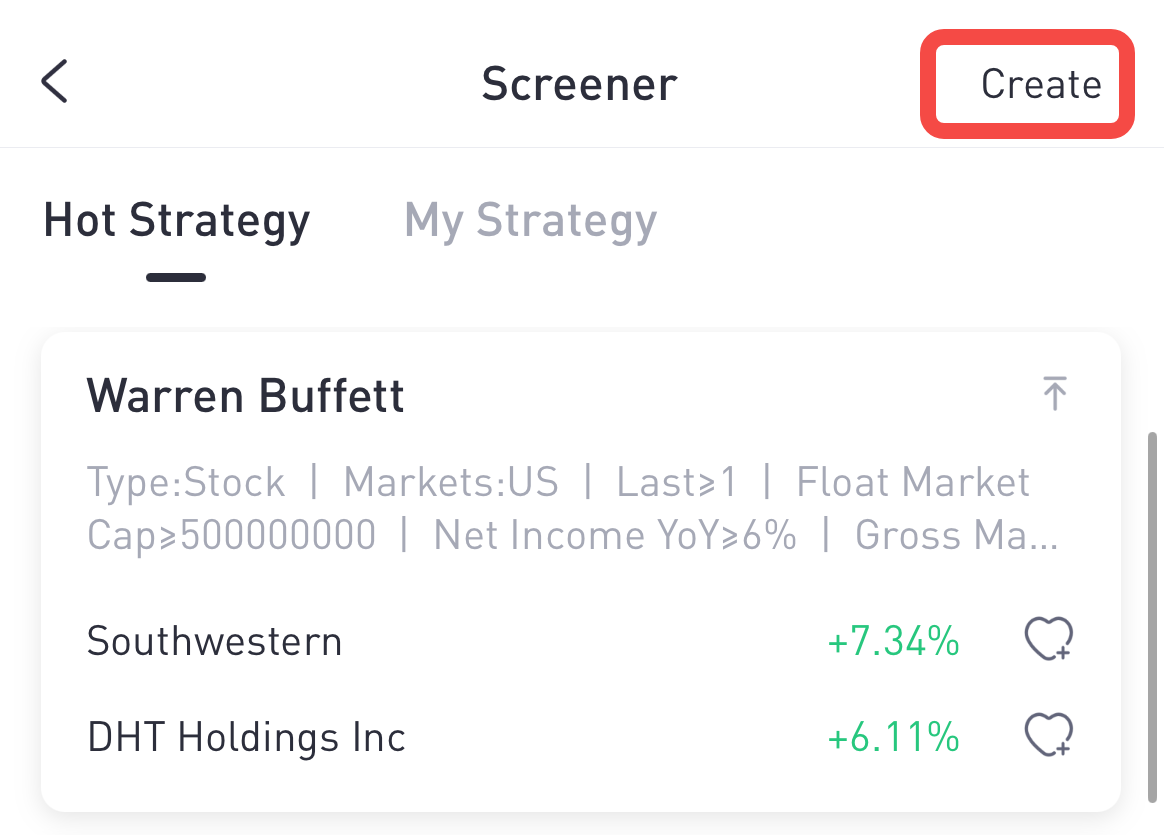

Try Tiger Trade's Screener tool! Here's how to use it:

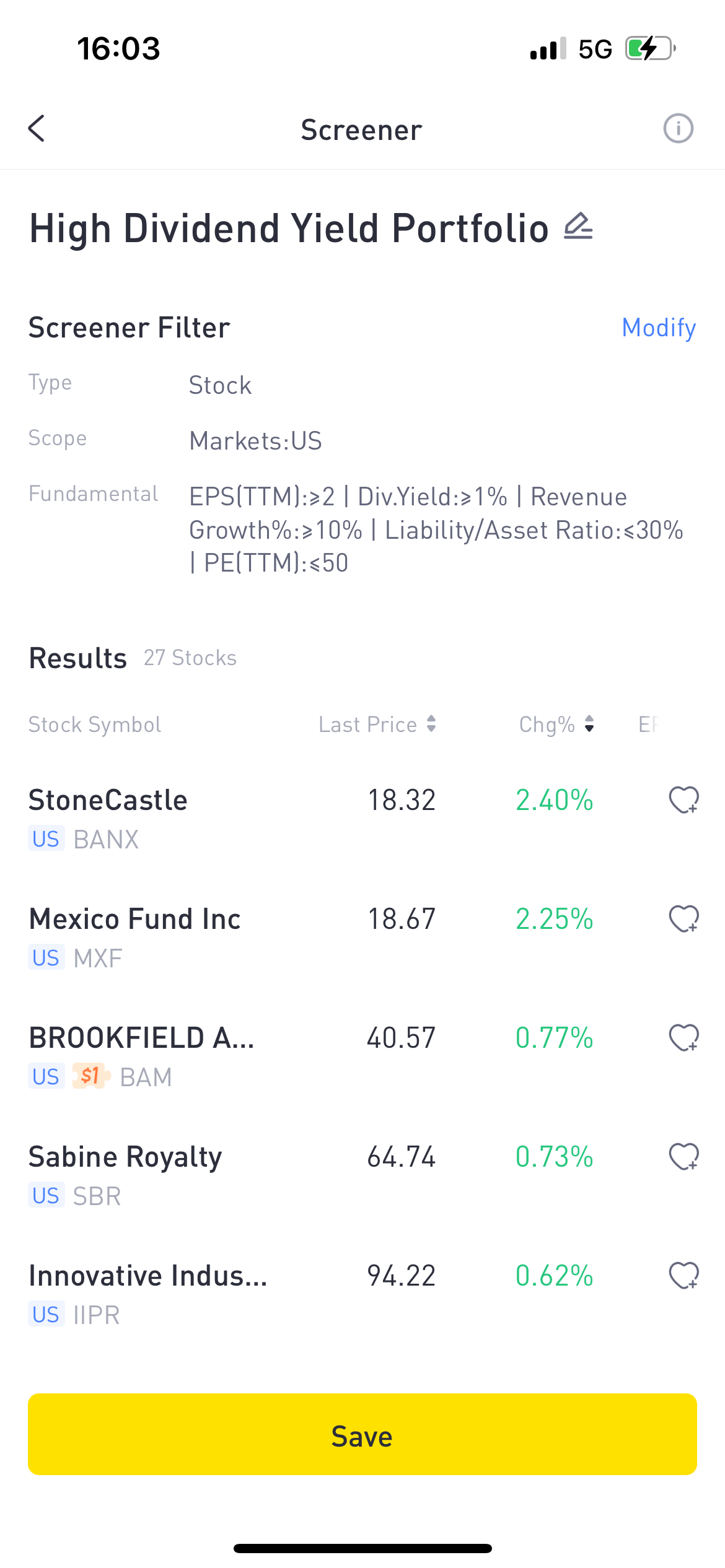

Step 1: Navigate to the 'Stocks' section, then select 'US Stocks' followed by 'Screener'. Here, create a 'High Dividend Yield Portfolio'.

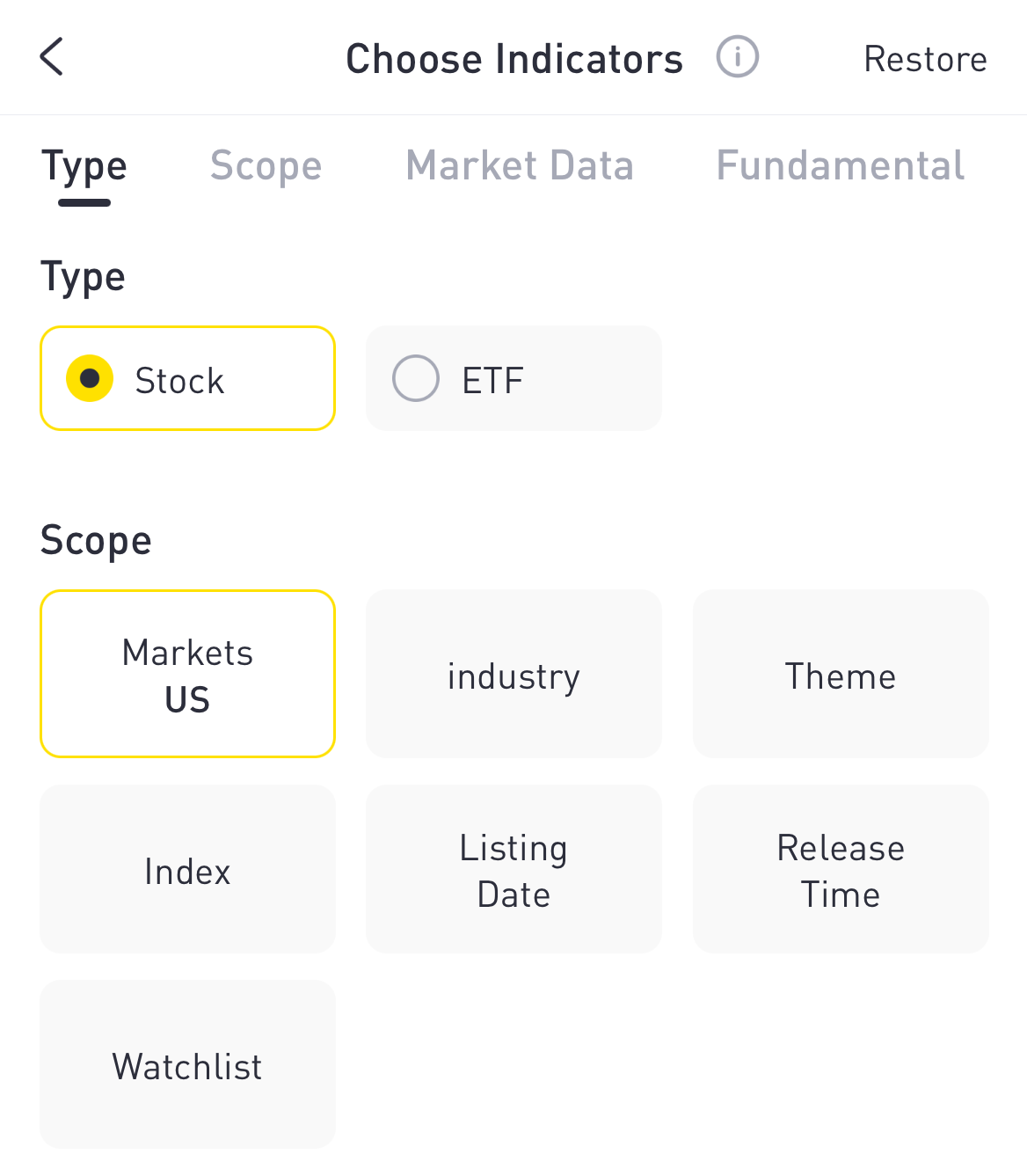

Step 2: Choose 'Stock' - 'Markets US' range. Use market data and fundamental analysis as filters. For long-term investments, it's better to filter using fundamental data.

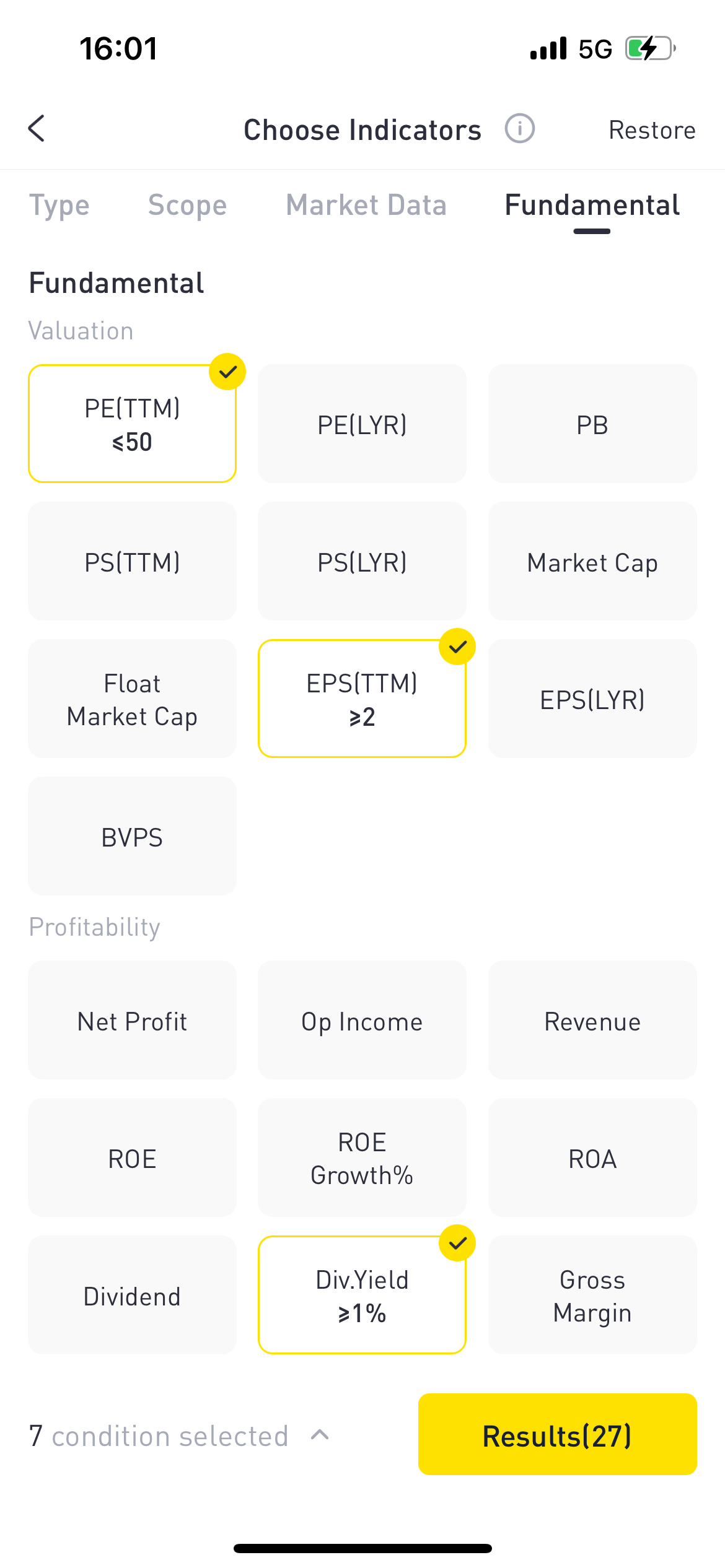

Step 3: Set specific values. The following are just examples:

For valuation metrics, use PE(TTM)* of 0 to 50 and EPS(TTM)* of ≥ 2 to find stocks with high investment value and profitability.

*TTM stands for Trailing Twelve Months, referring to the figures of the last 12 months/4 quarters.

The dividend yield is a key indicator for high-yield stocks. You might want to go for stocks with a yield of ≥1%.

Long-term growth is important too. Set Revenue Growth Rate of ≥10%.

Also, check the company's debt level. Setting Liability Ratio of ≤30% helps filter out companies with high debt.

With these settings, you can filter out 27 high-dividend stocks that meet these criteria. You can also customize other indicators and data based on your judgment.

Dividend Stocks vs. Dividend ETFs

Picking stocks can be tough. For a more diversified approach, consider dividend ETFs: VIG, VYM, and SCHD, which bundle various dividend stocks. The pro? They're more stable and spread risk across many companies, lessening volatility. The con? Unlike individual stocks diversified across industries, ETFs can suffer from overconcentration in a single sector, such as missing out on the performance of tech stocks in 2023. Plus, don't forget about ETFs' tax implications.

Ready to invest? Hold on! It's not as straightforward as it seems. You need to understand these misconceptions first:

Dividends Aren't Guaranteed: Companies can cut or stop dividends if they hit financial troubles. A very high dividend might be too good to be true and could indicate potential cuts.

Dividends Can Change: They're not set in stone. For example, during the 2008-2009 financial crisis, many banks cut their dividends. Diversifying through index funds can help reduce this risk.

Stock Prices Adjust on Ex-Dividend Days: Stocks often drop in value on the ex-dividend date, not the dividend payout date. This is to prevent people from buying just for the dividend.

Dividend Stocks Aren't Risk-Free: All investments have risks. Dividends can help, but they're not a surefire buffer against losses. Remember the case of RadioShack, which paid dividends until its losses widened in 2012.

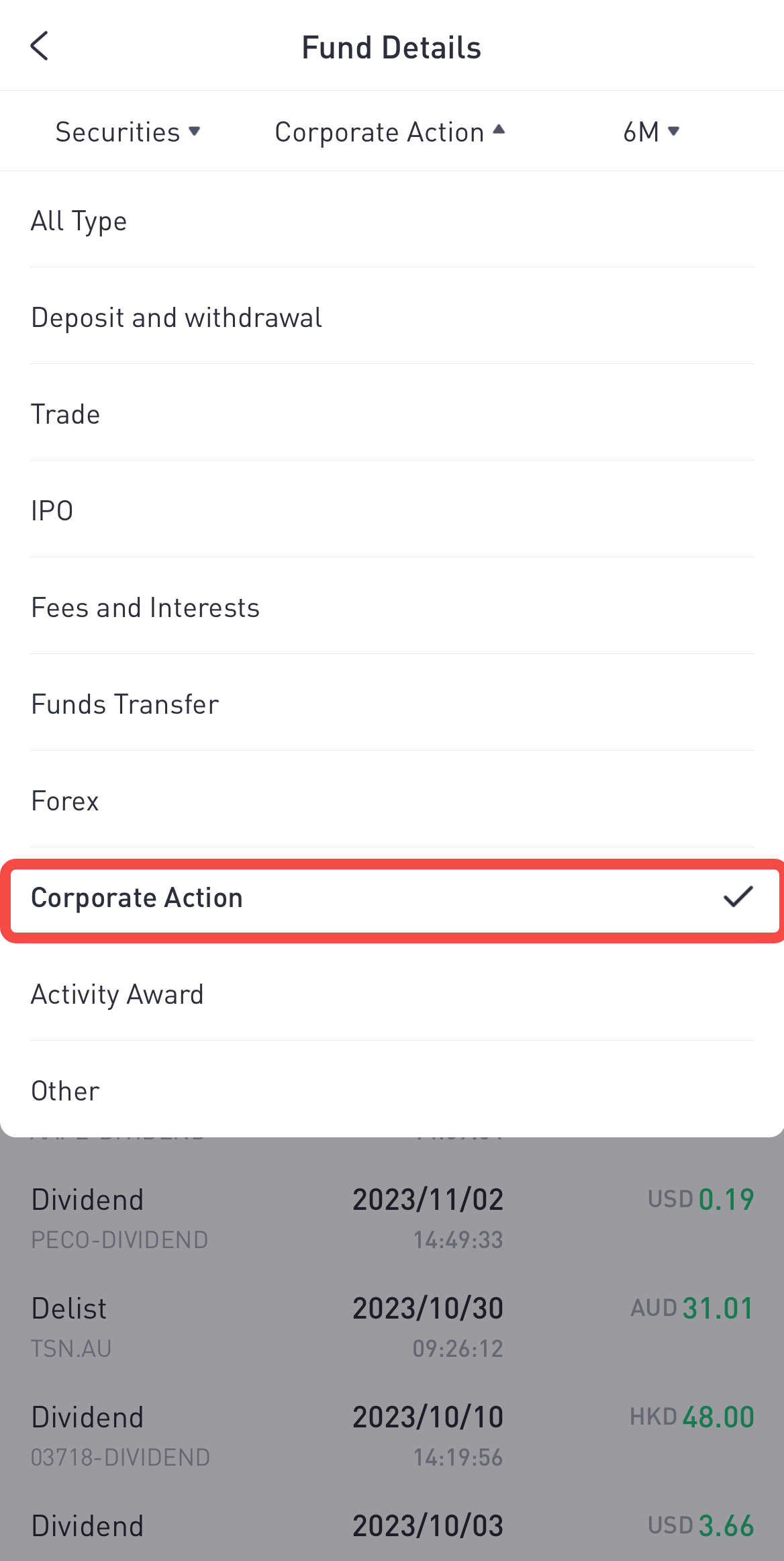

Taxes on Dividends: Taxes on dividends vary by region. For non-U.S. tax residents in New Zealand, a total withholding tax of 33% applies. However this rate could vary based on individual circumstances, like specific tax statuses or bilateral agreements. Therefore, it's recommended to consult a professional tax advisor to determine the exact tax rate for your particular situation.

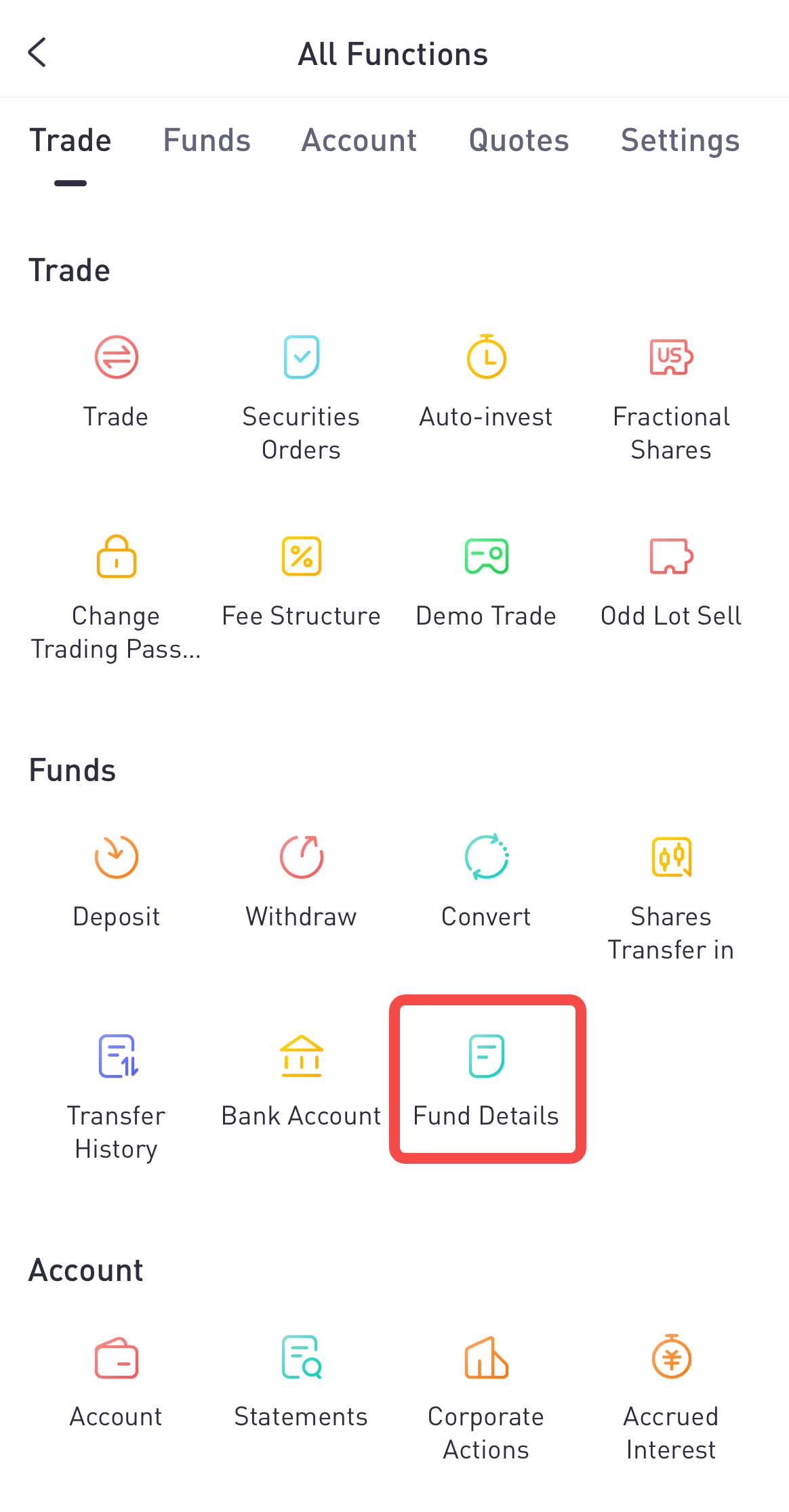

In Tiger Trade, you can view dividend details by navigating to 'Portfolio' - 'More' - 'Corporate Action'. Additionally, you can check the details of the dividend tax withheld under 'Fund Details' - 'Fees & Interest'.

In summary, investing in dividend stocks is generally a sound and cautious investment strategy. But it's crucial to understand that even the so-called 'established' dividend-paying stocks come with risks. In the current investment climate, if you're looking to select stocks that can provide steady and sustainable dividends, try targeting companies that are expected to have a long-term profit growth of 5% to 15%, robust cash flows, low debt-to-equity ratios, and a strong future competitive edge.

Tiger Trade is at your service when you are in the market looking for stock market treasures!

*Source: https://www.barrons.com/articles/dividend-stocks-bond-yields-9f2814b6

Disclaimer:

Investing carries risks, including the risk of losing an amount in excess of your initial investment. Past performance is not an indicator of future performance. This is not financial advice and should not be regarded as a solicitation or recommendation of acquiring or disposing of financial products. This email may refer to financial advice provided by third parties, and such advice has not been assessed or endorsed by Tiger. Leveraged trading carries a high level of risk and may not be suitable for all investors. Any content being discussed, shared, and commented does not takes into account your objectives, financial situation or needs. Please read our Disclosure Statements and Terms and Conditions available on our website, and consider whether acquiring or continuing to hold financial products is suitable for you before opening an account or making investment decisions. Please seek expert advice and ensure you understand these risks before trading. More information can be found at: www.tigerbrokers.nz.