Why invest in US market?

A true global gateway

The global reach experience offers access to some of the best companies in the US, including upcoming companies and startups with innovative products that emerge from time to time, delivering an extensive array of opportunities to invest in the latest trends.

Diversifies your portfolio

Apart from assets, industries and times, geographical diversification is also an aspect that is worth considering. As global companies are listed on the US market, investing in US stocks helps diversify investors' portfolios.

The largest market that carries great potential

The US market is an accessible, transparent, and liquid financial market, representing 40.9% of the $108 trillion global equity market cap, or $44 trillion (JUL 2022). As the largest stock market in the world, its transaction volume and market capitalisation make this market a unique investment opportunity for investors worldwide.

How we compare

| Amount to invest (US) |  Current Promotion* |

Standard fees |

Sharesies | Hatch | Stake | Superhero |

|---|---|---|---|---|---|---|

| $50 | $0.00 | $0.68 | $1.20 | $3.25 | $5.00 | $0.25 |

| $100 | $0.00 | $1.35 | $2.40 | $3.50 | $5.00 | $0.50 |

| $500 | $0.01 | $3.76 | $7.50 | $5.50 | $8.00 | $2.50 |

| $1000 | $0.02 | $5.52 | $10.00 | $8.00 | $13.00 | $5.00 |

| $5000 | $13.38 | $19.58 | $30.00 | $28.00 | $53.00 | $25.00 |

| $10,000 | $30.95 | $37.15 | $55.00 | $53.00 | $103.00 | $50.00 |

All fees are denominated in USD. Calculations are based on USD 200 per share, USD 0.6 for NZD 1, for one single buy order inclusive of currency exchange fees. Other platforms' pricing shown are their standard pricing and does not take into consideration membership plans, promotional offers, or other benefits if applicable.

*Available for a limited time for new clients who made their 1st deposit since 19 June 2023, other T&Cs apply.

Last reviewed: 17 July 2023. Visit the respective companies' websites for the most up-to-date information.

View detailed fee breakdown:

| Companies | Transaction fee | FX fee NZD.USD | Pass-through fees / Agency fee |

|---|---|---|---|

Funds account for 1st time* |

Fee waived up to USD 2 per order for a maximum of 4 orders per month, standard fees apply thereafter. | Fee waived up to NZD 2000 per month, standard fees apply thereafter. |

$0.003 per share (Waived for trading with less than 1 share ) 0.000008 × Trade Value (For sale only) $0.000166 per Share (For sale only) |

Standard fees |

≥1 share and ≤200 shares: USD 2 flat fee >200 shares: USD 0.01 / Share or 1% × Trade Value (Min. USD 2), the lesser of the two < 1 share: 1% × Trade Value, Max USD 1 |

0.35% | |

| Sharesies |

1.9% x Trade Value Cap at $5 |

0.50% | nil |

| Hatch |

≤300 shares: USD 3 >300 shares: USD 0.01 / Share |

0.50% | nil |

| Stake |

Trades up to USD 30,000: USD 3 Trades over USD 30,000: 0.01% x Trade Value |

1% minimum $2 per transfer |

0.000008 × Trade Value (For sale only) $0.0000119 per share (For sale only) |

| Superhero | 0 | 0.50% |

US$0.08 per $10k sold volume (For sale only) US$0.000166 per share (For sale only) |

| Features |  |

Sharesies | Hatch | Stake |

|---|---|---|---|---|

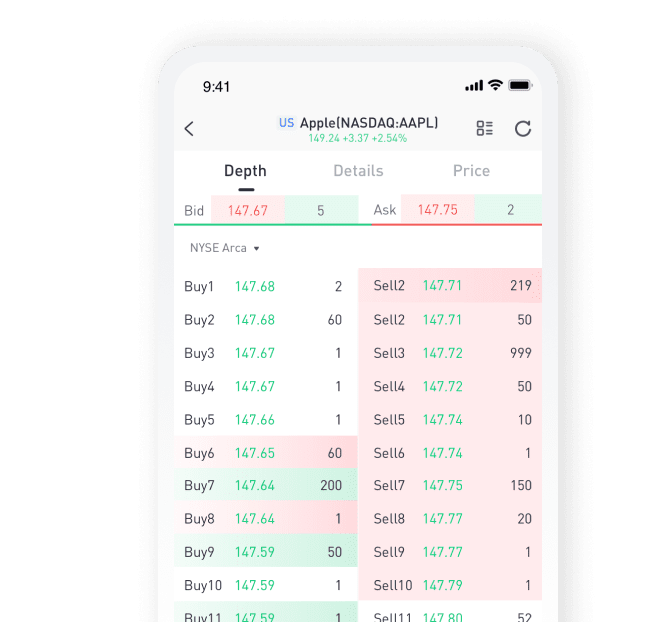

| Market data and depth | Live data with market depth for 40 levels | Delayed at least 20 minutes | Up to 15 minutes delayed | Live data |

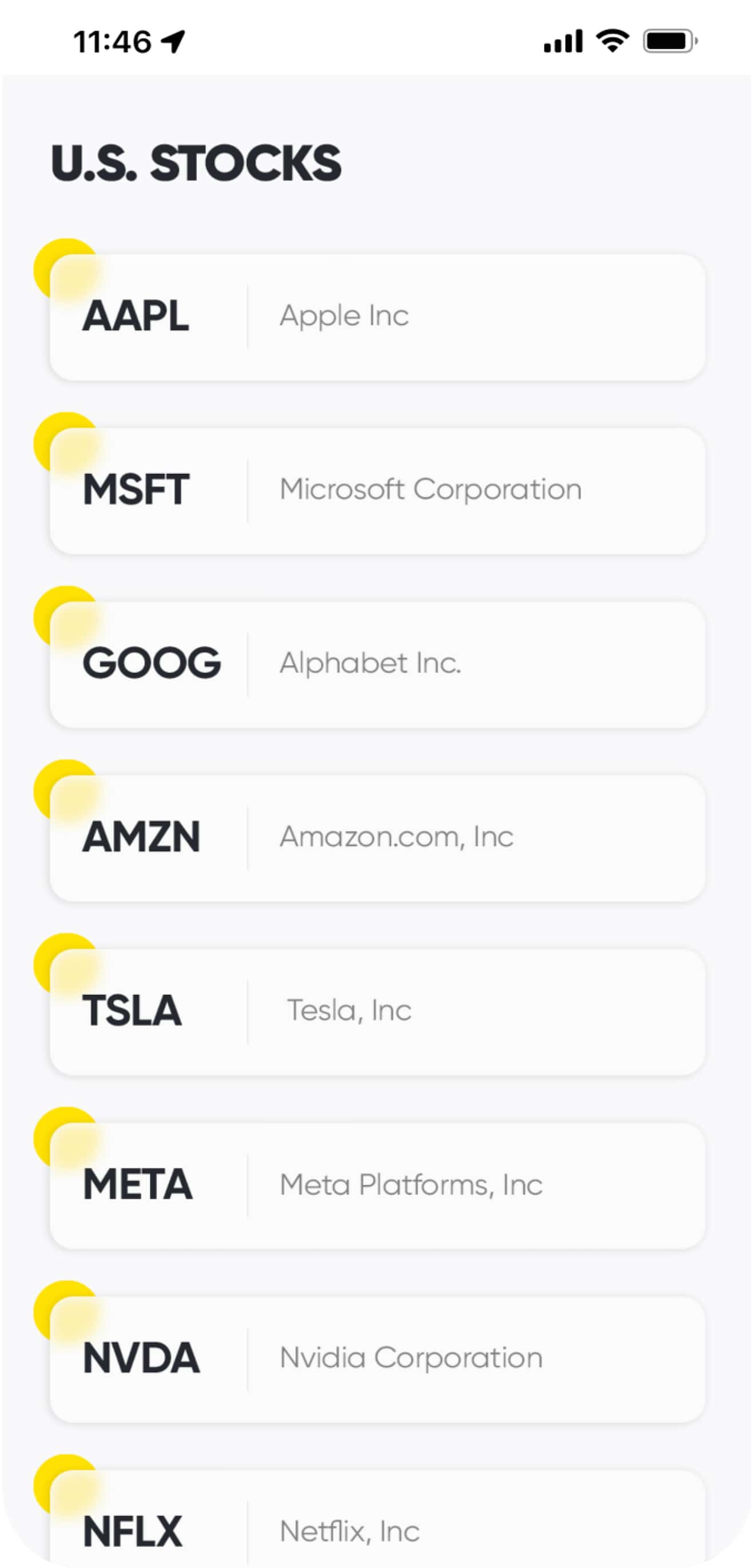

| Trading hours supported |

Pre-market: 5.5 Hours Regular trading: 6.5 Hours Post-market: 4 Hours Total: 16 Hours |

Regular trading: 6.5 Hours | Regular trading: 6.5 Hours | Regular trading: 6.5 Hours |

| Demo Account |

|

Not supported | Not supported | Not supported |

| App features |

|

|

|

|

Features compared are true and valid at the time of review on 6 October 2022. This is for general reference only, Tiger Brokers cannot ensure changes made by other companies are reflected in a timely manner. For the latest updates and information, please review the respective websites.

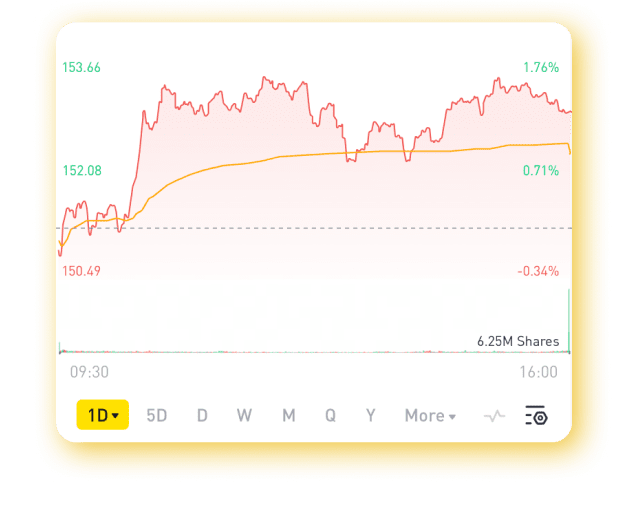

Pounce on market opportunities with streaming data

Active monitors function for pre- & post- market

Images displayed are for illustrative purposes only

Free real-time quotes with the latest stock price

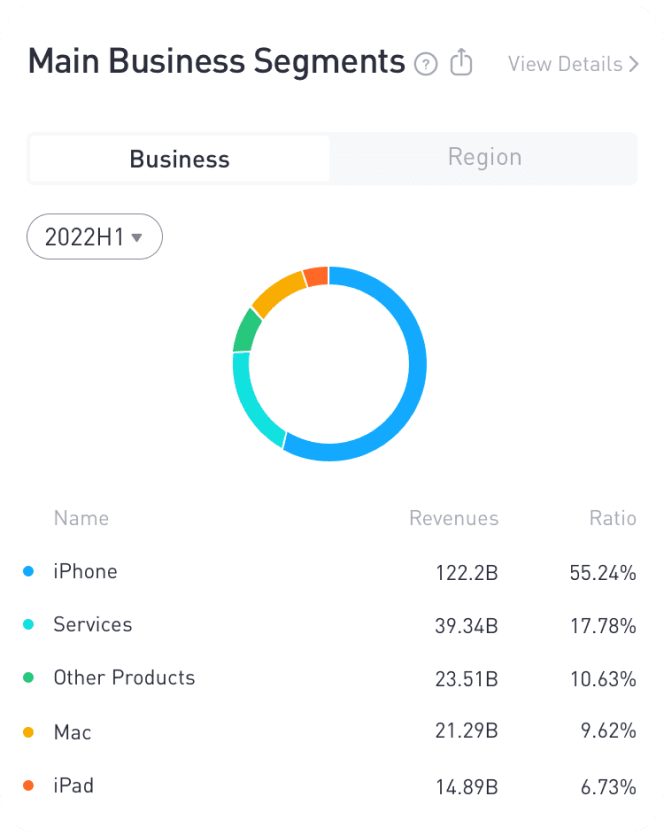

Free in-depth market data with 40 levels of bids and asks

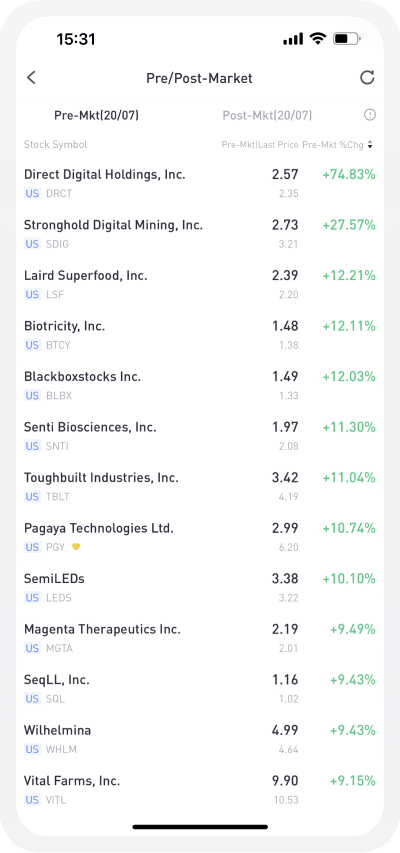

Decision making made easy with advanced tools

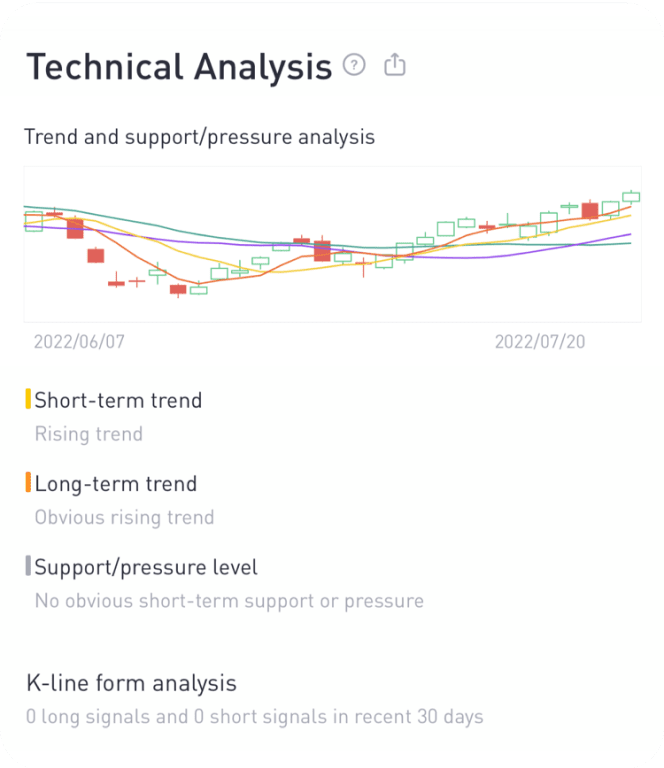

Over 38 technical indicators & 6 charting tools

Finding it hard to make your investment decision? Technical indicators are here to help:

- Develop your trading strategies

- Identify potential trading signals

- Commonly used by active investors to analyse short-term and long-term price movements

Charting tools assist investors in identifying market trends:

- Working with technical indicators to improve your analysis accuracy

- Pairing with risk management tools to help you take advantage of market reversal

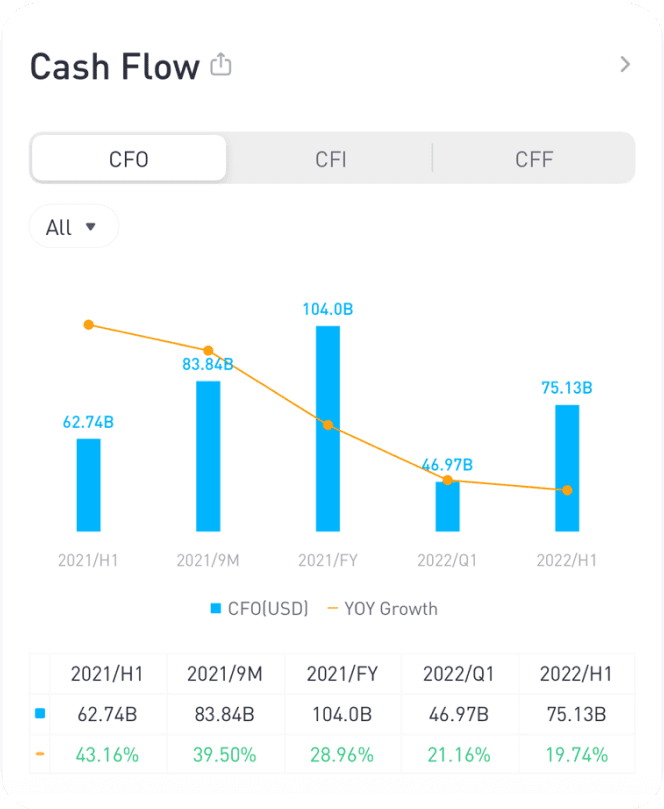

Evaluate your investments with in-depth companies analysis

Valuation | Fundamental | Technical | Financial

Images displayed are for illustrative purposes only

Smart stock filters to discover more investment ideas

Targeted searches with split-second results are all in the palm of your hand with Tiger Trade's comprehensive smart stock filters. Quickly and easily find lower PE companies, companies with revenue growth rates above 20% or market values above $200 billion.

Images displayed are for illustrative purposes only

Pricing

flat fee to buy or sell up to 200 shares and USD 0.01 for every additional share after that per transaction.

| Trade Volume | Fees |

|---|---|

| ≥1 share and ≤200 shares | USD 2 flat fee |

| > 200 shares |

USD 0.01 / Share, or 1% × Trade Value (Min. USD 2) The lesser of the two |

| Type | Fees |

|---|---|

| Settlement Fee |

USD 0.003 / Share Max 7% × Trade Value |

| SEC Membership Fee (Charged for sell orders only) |

0.000008 × Trade Value Min. USD 0.01 / Trade |

| FINRA Trading Activity Fee (Charged for sell orders only) |

USD 0.000166 / Share Min. USD 0.01 / Trade Max USD 8.30 / Trade |

Notes:

(1) Trading low-priced shares (e.g. share price less than USD 1) may carry high risk, including the risk of total loss and that of delisting. Investors should be cautious about buying or selling these shares.

(2) Settlement Fee is a pass-through fee charged by the US clearing agency and DTCC (US Depository Trust & Clearing Corporation) member TradeUP Securities Inc.

(3) SEC Membership Fee is a pass-through fee charged by SEC (US Securities and Exchange Commission) and is charged for sell orders only.

(4) FINRA Trading Activity Fee is a pass-through fee charged by FINRA (US Financial Industry Regulatory Authority).

(5) If there is any change in the fees charged by third parties such as exchanges and regulators, TFNZ will adjust the fees they charge on their behalf accordingly.

(6) For fractional share trading with trade volume less than 1 share, transaction fee is charged at 1% of Trade Value, capped at $1. There is no pass-through fees to apply. For fractional share trading with trade volume more than 1 share, normal US trading fees hereabove apply.

| Type | Fees |

|---|---|

| ADR Fee | USD 0.01 - 0.05 / Share |

| Real-time Quotes Fee | Free, subject to terms and conditions of related campaigns |

| Proxy Service Fee for Participating in the General Shareholders' Meetings | USD 10 / Successful Application |

Notes:

(1) ADR (American Depositary Receipt) Fee is charged by DTCC for stocks of non-US companies listed in the US Clients who held such stock positions in a past cycle will be charged ADR fees as required, regardless of whether they have a current position or not. Please refer to Tiger Trade's push notifications for information on the cycle period. Clients who have not held any non-US company's shares will not be charged ADR fees.

(2) Interested clients may choose from two ways of general shareholders' meeting participation application: (i) Client or proxy participates; (ii) Client votes. Proxy Service Fee for Participating in the General Shareholders' Meetings will be refunded to the client in the event that the application is unsuccessful.