1. Basis of auto-invest in the Tiger Trade app

1.1 What markets are available to invest in, using the auto-invest function in the Tiger Trade app?

Currently, the auto-invest plan is available for the most popular US and HK shares.

1.2 How do I set up auto-invest in the Tiger Trade app?

In order to participate in an auto-investment plan, you will need to:

Set up a regular payment from your bank acount into your Tiger Trade auto-invest plan, or transfer a lump sum into your auot-invest plan. If you transfer a lump sum, please ensure the amount will cover the amount that you have chosen to use for your auto-invest purchases.

Hold cash in US or HK currency, which means you will have to convert NZD to USD or HKD before the order is placed.

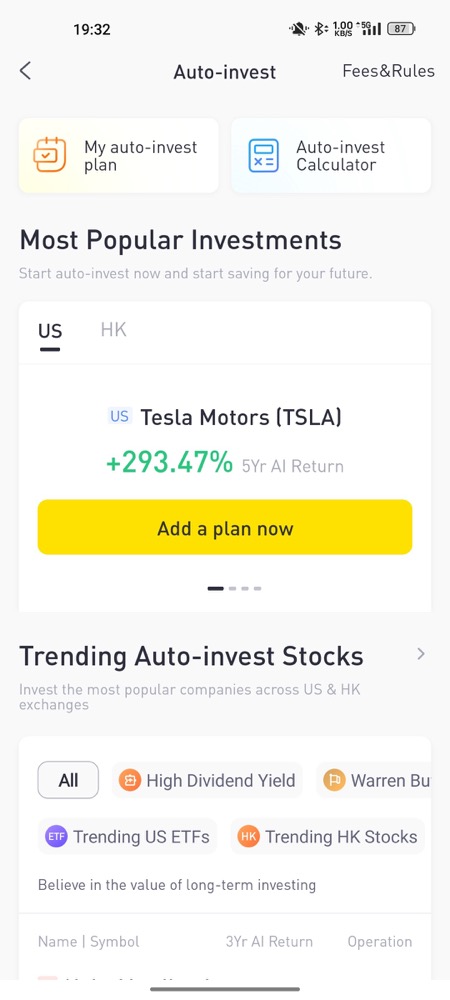

Set up the auto-invest plan in the app, select your preferred stock, click on "Add a plan now", enter the amount and the frequency you want to regularly invest in and submit the plan as shown below:

1.3 What is the minimum amount that I can start to auto-invest with?

The minimum amount to start an auto-investment is USD 2 for US stocks and HKD 500 for HK stocks.

1.3.2 Can I trade on margin for my auto-investment plan?

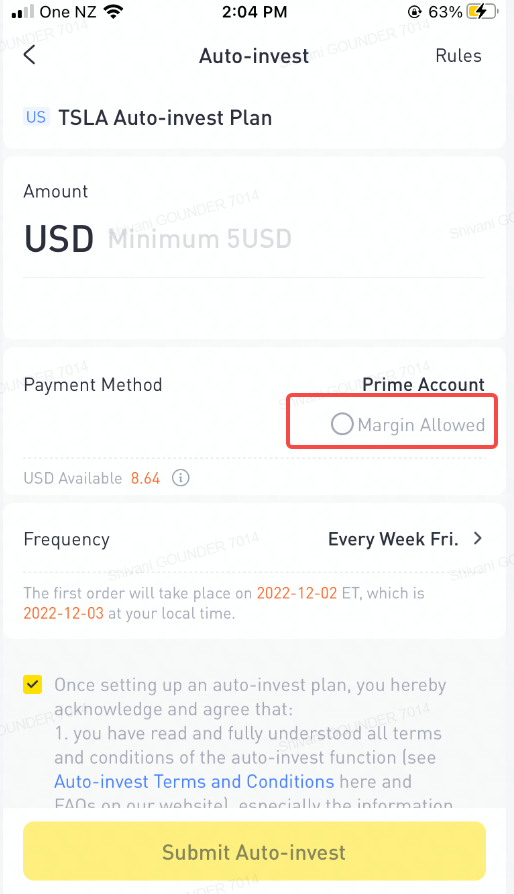

Yes, if you have a margin account, then you can purchase stocks using margin. However, you need to manually open the function by choosing "Margin allowed" as shown below when you set up the auto-invest page. If you select to use margin, then please ensure you have enough funds in your cash account otherwise margin interest may occur.

1.3.3 Will the funds be directly debited from my bank account?

Yes, the user is able to select / add a bank account as a payment method. Auto currency conversion will be enabled when the user chooses to auto-invest via the bank account and the deposit currency is different from the trade currency.

1.3.4 Can I use vouchers or commission-free cards for auto- invest?

Auto-invest supports the use of auto-invest vouchers.

1.3.5 When and at what price will the investment be filled?

For US stocks' auto-investment, the order will be placed as a market order on the date specified by you at around 13.30pm EST. If the market closes early in the day, the order time will be advanced to around 10.30 am EST.

For HK stocks' auto-investment, the order will start to excute on the date specified by you at around 9.00 am HKT.

For both markets, if the day is non-trading day (that is Saturday, Sunday, or a legal holiday), the order time will be postponed to around 13.30pm EST (or 10.30am) or 9:00am HKT on the next trading day. If the extreme weather conditions caused the temporary closure of the exchange, auto-investment will be failed on the day.

1.3.6 At what time zone will the order be executed?

Your auto-invest orders will be executed at the time corresponding to the US or HK exchange. Say for example, if you set up a weekly US stock‘s auto-invest plan for Monday, then the execution time will be every Monday Eastern time.

1.3.7 If I have multiple auto-invest set up, in what order will they be executed?

Your investment will be executed in the order it was created.

1.3.8 Can I cancel or modify my auto- investment plan?

Yes, you can make changes to your plan however, you will not be allowed to modify or cancel the auto- investment plan half an hour before the execution of the auto- invest order. Auto-Investment orders can not be cancelled after the orders are placed.

1.3.9 How can I cancel or modify my auto- investment plan in the Tiger Trade app?

To cancel or modify your auto investment plan go to My auto invest plan>click on the stock/ETF>manage>choose edit or cancel the plan.

1.3.10 Can I resume my auto- invest plan after cancellation?

Yes, you can resume your cancelled investment plan under My Auto- Invest Plan.

1.3.11 Why did you skip my current investment cycle?

Your auto- invest plan may have been skipped for the following reasons:

The ETF or stock cannot be traded on the day.

A circuit breaker is encountered when placing an order.

Your securities account currently has trading restrictions.

You did not have enough funds in your Tiger Trade prime account.

The order may trigger a margin call notification on the margin account.

1.3.12 Will I get a reminder before my order is executed?

Yes, an in-app notification will be sent 2 calendar days (EST/HKT) before the auto- invest plan order is executed.

1.3.13 Will I get a reminder if my order is filled or cancelled?

Yes, an in-app notification will be sent when an order is filled or cancelled. Also, the failure of a scheduled order will not affect your auto-investment plan for your future orders.

1.3.14 Where can I check my order?

You can check your order on the Tiger Trade app>go to Portfolio>Orders. You can also check your orders by clicking on Portfolio>More>auto- invest.

1.4 What are your fees for auto-investment?

For US stocks auto-investment, when the number of stocks filled is less than 1 share, we will charge a fee of 1% of the transaction amount, up to a maximum of $1 US dollar. When the number of stocks filled is greater than or equal to 1 share, standard US stocks & ETFs trading fees apply.

For HK stocks auto-investment, it is consistent with the current fee schedule.

1.5 Other things you may need to know about auto-invest in HK market

If the investment amount you set is not enough to buy one board lot of stock, it may be purchased in an odd lot. Since the transaction price for odd lots may be inferior to the transaction price for board lot shares, it is possible to have a filled price higher than the market high displayed on the stock detail's page or to have a filled quantity for 0 shares.

Some customers may experience a filled quantity for 0 shares, including but not limited to:

The system has insufficient auto-invest funds to buy 1 board lot of stock after deducting the estimated fees.

Poor market liquidity or extreme weather conditions cause relatively low overall purchase volume.

Tiger will decide on the specific purchase volume based on its own risk control rules and the market situation on that day. If the overall purchase volume is relatively low, it is possible to have a filled quantity of 0 shares.

2.Auto-invest rate of return and calculator formula description

2.1 Auto-invest rate of return:

2.1.1 What is auto-invest rate of return?

The auto-invest rate of return is a historical back-test rate of return, which is calculated based on the historical price of stocks and ETFs, assumptions including the system set auto-invest period and auto-invest duration, and etc. The calculation result of auto-invest rate of return is for reference only, and does not represent a prediction or guarantee of future returns, nor does it constitute any investment advice. Tiger Brokers cannot guarantee the accuracy of the calculation result. Investors need to independently evaluate the risk well to make investment decisions.

2.1.2 How to calculate the back-test return rate of auto-invest?

The auto-invest rate of return adopts a simple yield calculation formula: that is, the auto-invest yield = the cumulative return in the auto-invest cycle/the cumulative auto-invest amount in the auto-invest cycle * 100%

Accumulated Return = (Current Price * Accumulated auto-invest Amount) - Accumulated Auto-invest Amount

Cumulative auto-invest amount = auto-invest amount per period * auto-invest period

2.1.3 The relevant assumptions of the auto-invest rate of return formula?

Auto-invest frequency: when calculating auto-invest rate of return, the frequency of auto-invest is set default to a every week Monday. If Monday of the auto-invest cycle is a non-trading day, the system would then skip this cycle.

Auto-invest cycle: Take the last calendar day as the starting point, and every 365 calendar days in history as 1 year, and so on. If the listed time of the investment is less than a whole year(or 365 days), only the remaining actual days are calculated in that year.

Auto-invest price: The auto-invest transaction price and the current price are calculated from stock split price . If there is a corporate action such as a stock split, the calculator will generate the results by using the split-adjusted prices. Dividends, commissions and other transaction fees (such as foreign exchange fees) are not included in the calculation of historical back-testing yields.

2.1.4 How often is the auto-invest yield updated?

The auto-invest yield is updated on a daily basis based on the closing price of the most recent trading day. The price of the actual order may fluctuate from this price, so the reference value of the results displayed in this calculator may be limited and investors should not rely entirely on this calculation.

2.2 Auto-invest Calculator

2.2.1 What is a fixed cast calculator?

The Auto-invest Calculator is a visual tool to back test historical return rate of auto-invest plans. Based on the historical prices of stocks and ETFs, the historical rate of return can be computed by setting parameters such as the fixed investing amounts, investing frequencies, and investing length. The calculation result of auto-invest rate of return is for reference only, and does not represent a prediction or guarantee of future returns, nor does it constitute any investment advice. Tiger Brokers cannot guarantee the accuracy of the calculation result. Investors need to independently evaluate the risk well to make investment decisions.

2.2.2 How to calculate the back-test return rate of auto-invest calculator?

The back-test return rate of auto-invest calculator is the same as the back-test return rate of auto-invest. It adopts a simple yield calculation formula: that is, the auto-invest yield = the cumulative return in the auto-invest cycle/the cumulative auto-invest amount in the auto-invest cycle * 100%.

Accumulated Return = (Current Price * Accumulated auto-invest Amount) - Accumulated Auto-invest Amount.

Cumulative auto-invest amount = auto-invest amount per period * auto-invest period

2.2.3 What assumptions is the calculator based on?

The back-testing historical return of the calculator is based on the closing price of the relevant auto-invest date, however, the price at the time of placing actual auto-invest orders may fluctuate from the closing price. Therefore, the results shown on the calculator may have limited reference value and investors should not rely solely on those calculation results.

If there is a corporate action such as a stock split, the calculator will generate the results by using the split-adjusted prices.

The results do not take into account the impact of dividends, commissions and other transaction fees (e.g.: foreign exchange conversion fees).

The auto-invest period takes the latest trading day as the starting date and traces back to 365 days to the historical date as 1 year, 730 (365+365) days as 2 years, and so on. If the stock or ETF listing time is less than a whole year (for example, less than 365 days, 730 days, etc.), the auto-invest period is based on the actual days.

If during the back-test period, the auto-invest implementation day happens to be a non-trading day or the underlying stock or ETF does not support trading, the test will skip this trade and does not count it in the calculation.

2.2.4 What can investors get from the auto-invest calculator?

Comparing the historical returns on auto-invest of different stocks or ETFs within the same period.

Comparing the historical returns on auto-invest of the same stock or ETF investment within different periods or with different investing frequencies.

Recommended screening criteria for the most popular investments.

3.1 What are the screening criteria for the most popular Stocks/ETFs?

The most popular investments display those stocks/ETFs available for auto-invest with the highest trading volume and positive back-testing returns of the auto-invest during the recent 3 calendar months.

3.2 How often is the above investment list updated?

The above investment lists are updated the second week of the month.

4.1 What indicators do you provide to screen out popular Stocks/ETFs?

High Dividend Yield: Dividend Yield>=4%,2. Price>$5

Warren Buffet: Float market cap>=$500M,2. Net profit growth rate annual>=6%, 3. Growth margin (TTM) annual >=30%, 4. OP/EBT annual >=70%, 5. ROE YOY annual >=10%, 6. Price>$1

Value & Growth: P/E (TTM) 0-30,2. Market Cap>$500M, 3. ROE YOY annual >=20%, 4. Growth margin (TTM)>=5%, 5. Revenue growth rate annual>=20%, 6. Price>$1

Undervalued: Float Market Cap>=$500M,2. Growth margin (TTM) annual >=30%, 3. P/E (TTM) <=15, 4. Price>$1

4.2 How often are the above indicators updated?

Among the above indicators, the stock price & dividend yield is the latest price & ratio, and the circulating market value, total market value and Price-To-Earnings Ratio refer to the data of the most recent trading day.